PDF editing your way

Complete or edit your form 80 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 80 australia directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 80 australian visa as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your form 80 immigration australia by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 80

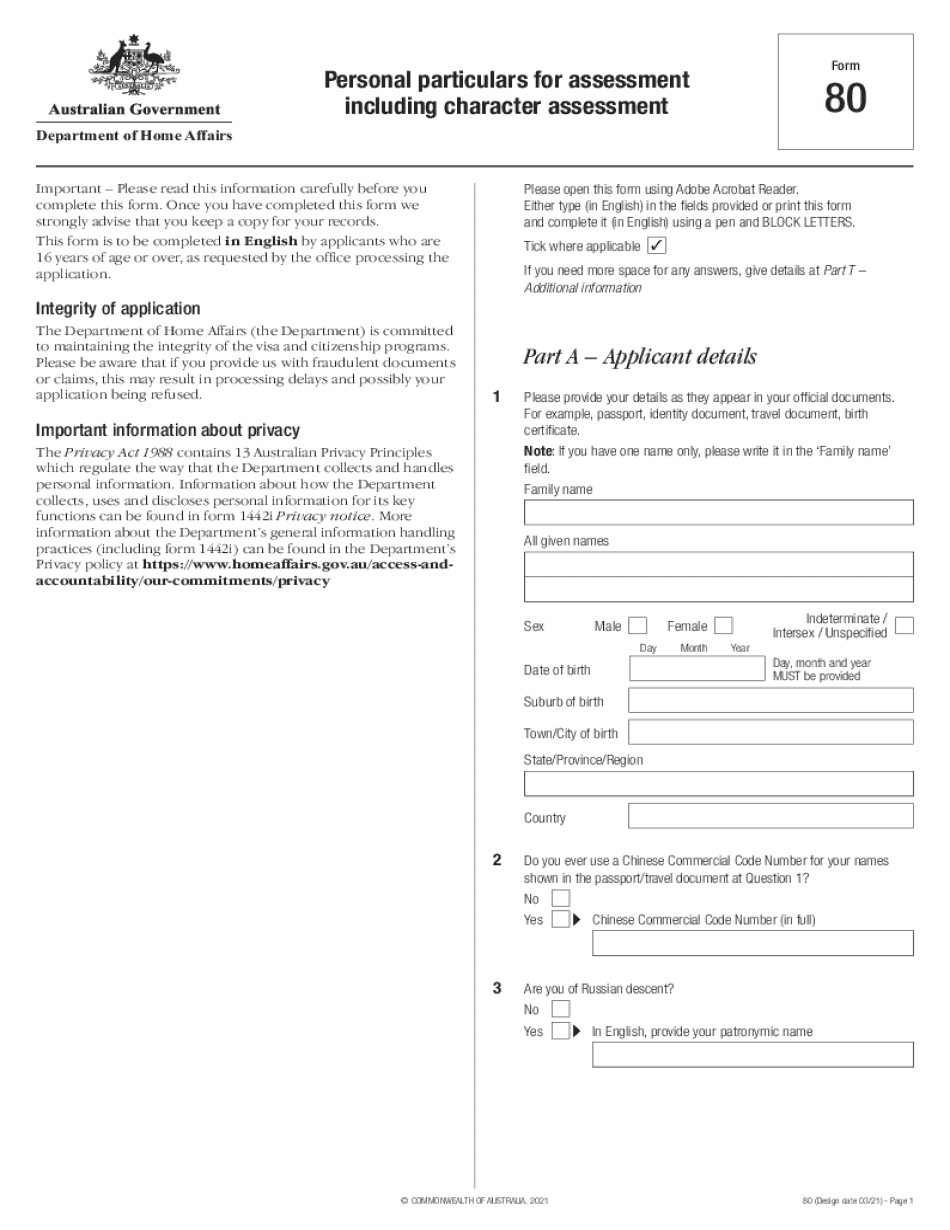

About Form 80

Form 80 is a document that needs to be submitted by individuals who are applying for Australian Citizenship or a visa that involves a character assessment. This form is a detailed questionnaire that gathers information on an individual's personal, employment, and educational history, as well as any past criminal convictions, military history, and travel history. It is used by the Australian government to assess whether the applicant is of good character and meets their requirements for entry or citizenship. The information provided in Form 80 will be used to determine an individual's eligibility for a visa or citizenship and may also be used to conduct further checks on their background. Typically, Form 80 is required for visa categories such as the Partner Visa, Skilled Visas, and Business and Investment Visas. It is also required for individuals applying for Australian citizenship. It is important to ensure that Form 80 is completed accurately and honestly, as any false information provided could lead to the refusal of the visa or citizenship application.

What Is Form 80?

Form 80 is a document usually known as a visa application. It is useful for individuals who plan to visit Australia and is requested by Australian Department of Immigration and Border Protection. This form is necessary either for travelers and refugees in order to obtain travel document to cross the border of Australia.

While preparing Form 80 notice that you need to include your ID card and ticket information. So it is advised to make some copies of the documents mentioned above.

You should fill the blank form out before entry to Australia in case your trip is planned due to business or family reasons. The submission of this document should be decided with the Department of Immigration and Border Protection office if a person is seeking asylum or applies for a temporary residence.

Pay attention to the list below to figure out the required information.

- Pryour personal data from your passport. Include details connected with your citizenship, birth registration, address, telephone number etc.

- Write in your partner’s data.

- Insert the date of your trip, hotel reservations. Don’t forget to mention the purpose of your travel plans.

- Enter the details from your current visa in case you have one.

- Additional info is important too. Indicate your previous travel history, education, addresses etc. Pryour family’s data.

- Answer the questions connected with your criminal past, debts and so on

- Sign the document.

- There is one more sheet to fill out. You may use it in case you need more space for the answers.

Once the Form 80 is already created, print it to have on hand or send it at once to the Australian Department of Immigration and Border Protection.

Online answers aid you to organize your document administration and supercharge the productiveness of the workflow. Abide by the quick information to be able to complete Form 80, stay clear of problems and furnish it in a very timely manner:

How to complete a Form 80 Australia?

- On the web site aided by the sort, click Initiate Now and go towards the editor.

- Use the clues to complete the pertinent fields.

- Include your own facts and contact facts.

- Make positive that you just enter proper info and quantities in best suited fields.

- Carefully examine the written content within the form in addition as grammar and spelling.

- Refer to aid portion if you have any doubts or deal with our Help group.

- Put an digital signature on your own Form 80 together with the assistance of Indicator Tool.

- Once the shape is completed, press Executed.

- Distribute the ready kind via e-mail or fax, print it out or help you save in your equipment.

PDF editor permits you to definitely make modifications on your Form 80 from any web linked machine, personalize it based on your preferences, indication it electronically and distribute in various options.