Award-winning PDF software

Form 80 for Lewisville Texas: What You Should Know

D)(2) of the Texas Public Works Code, a notice of intent, stating that all or part of the costs of the project are being withheld from the wages of any employee who receives payment for working on the project, shall be considered to be a statement on a City of Lewisville, Texas, document, and shall be accepted as part of the disclosure of such costs. The City s response to the disclosure shall be deemed to have satisfied the requirements of Subsection 13.01 of the Texas Tax Code. LOT TYPE 6 – 70' LOT An assessment of the fair market value of the real property as of the date of the assessment and such additions thereto as may take place upon the construction of the improvements. For the purpose of determining fair market value, the following factors shall be considered: the condition of the real property; the amount and nature of improvements and costs necessary for the completion of the improvement; the cost of the materials used, labor, and equipment required for the construction; and the depreciation of the improvements. A. The assessment may not be based on a percentage of the fair market value of the real property unless the assessment is approved in writing by City Council. B. City Council may approve this notice of intent, at any time, without reference to any other provisions contained in this ordinance. The City Council may, for administrative convenience, extend the time period for providing written approval of an assessment. The City Council may, for administrative convenience, grant an exemption from assessment when the applicant demonstrates that the construction or improvement is necessary or advisable to accomplish a designated or anticipated public purpose or interest. This exemption expires for one (1) year, unless extended by the City Council. The City Council may, at any time, with its consent, extend an assessment for no more than one (1) additional year. The City Council may, for administrative convenience, extend the time period for providing written approval of an assessment. C. The assessment shall be levied, and its proceeds, and the assessed taxes that will have been collected under this ordinance shall be used only for the purpose of making the payment required under this ordinance for the benefit of the Tax Assessor and the City. Any surplus after payment of the obligations under the assessment shall be placed in the General Revenue Fund. D.

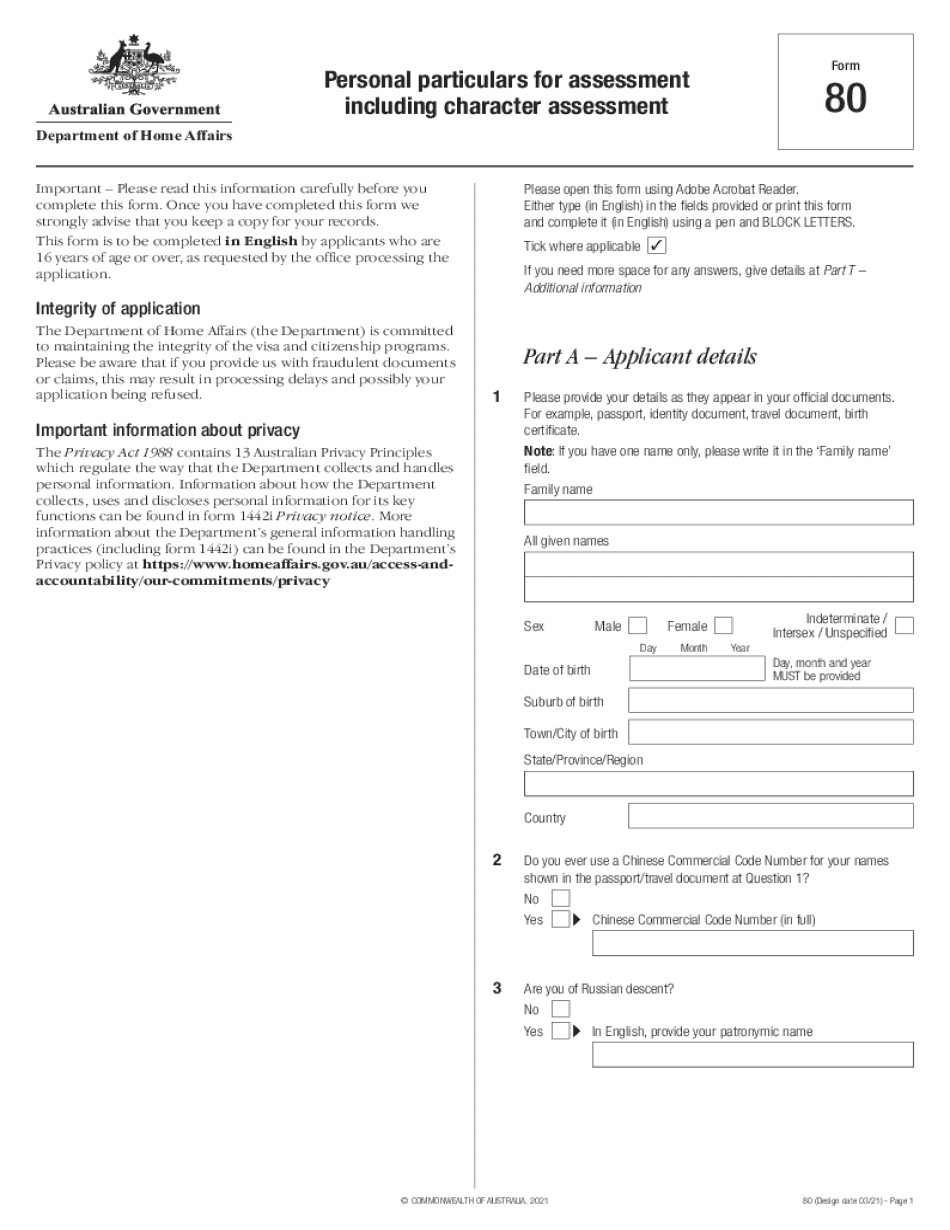

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 80 for Lewisville Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 80 for Lewisville Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 80 for Lewisville Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 80 for Lewisville Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.