Award-winning PDF software

Form 80 Questions 25 & 26 - British Expats: What You Should Know

The U.S. has established this system of taxation (and its related regulations) to ensure that a foreign person or nonprofit organization is not subject to taxes on its income under the Internal Revenue Act. However, a person or organization that does not have an “earnest desire to come to the United States” and the “willingness to pay taxes in the United States” is generally not a treaty candidate. (Tribal Jurisdiction) Integrity of Applications — IRS Jan 12, 2025 1) Is information required for all forms? (No) 2) Is all information on the form confidential? (Yes) 3) Can we use Form W-9 for tax purposes without sending Form 8821 to the address on the official form? (No) 4) Can we use Form 8821 for payment purposes without sending all the required information to the address on the form? (No) 5) Can we get someone else to fill out the form for us on our behalf to get it to the correct address? (Yes) 6) Is there any way to indicate in the form that the information is being provided to you? (Yes) 7) How is income earned computed and reported? (The gross income is reported on Form 1040.) 8) Does the reporting of earned income affect the income tax? (No) 9) What kind of deductions do I have to make under the Federal earned income tax credit (ETC)? (Only the first 100 of Earned Income Credit for Qualified Child Tax credit, the first 10,000 of earned income limitation for Child Tax credit ETC for Qualified Family Tax Credit, and the first 1,000 of the Qualified Dividend Tax Credit). Integrity of Forms — Internal Revenue Service Jan 9, 2025 — The form may contain a number of questions and forms relating to your financial status (e.g., filing status and occupation, employment and payroll info, etc.), that apply only to your case and cannot be accessed by the public, and that the IRS will determine whether you may qualify for a form called a “Special Taxpayer ID.” These documents must be provided to the IRS when making an application for tax- paid status, as the specific information needed to prove such status (e.g.

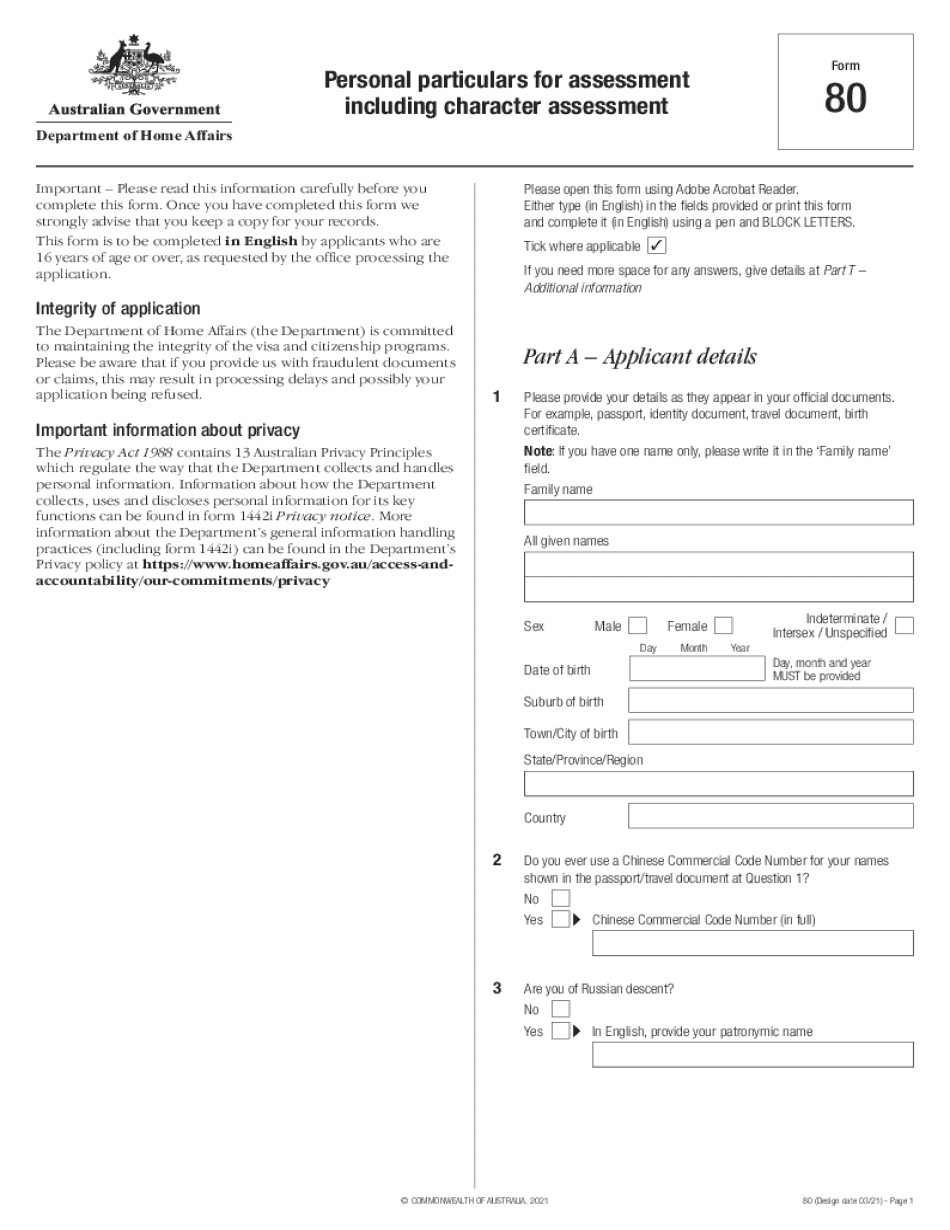

Online remedies enable you to to prepare your document administration and improve the efficiency of one's workflow. Go along with the fast guidebook in an effort to finished Form 80 questions 25 & 26 - British Expats, keep away from problems and furnish it inside a timely method:

How to accomplish a Form 80 questions 25 & 26 - British Expats on the net:

- On the web site along with the variety, click Get started Now and pass on the editor.

- Use the clues to fill out the suitable fields.

- Include your own material and call data.

- Make guaranteed which you enter suitable knowledge and figures in ideal fields.

- Carefully take a look at the content material on the type in the process as grammar and spelling.

- Refer to help segment if you have any problems or deal with our Support team.

- Put an digital signature on your Form 80 questions 25 & 26 - British Expats together with the help of Indicator Resource.

- Once the shape is finished, push Performed.

- Distribute the all set variety by using e mail or fax, print it out or preserve with your device.

PDF editor allows for you to make variations for your Form 80 questions 25 & 26 - British Expats from any world-wide-web linked equipment, customize it according to your preferences, sign it electronically and distribute in various ways.